“ shouldn’t have to further enrich colleges by taking on a mountain of debt or mortgage their lives in order to get a good-paying job," Hawley said. "Yet, we have a system that preferences students who want to attend a four-year college over Americans who want to learn a skill. He will introduce legislation that makes colleges and universities financially responsible if you default on your student loans. (However, it's possible the federal government could de-risk by securitizing these loans and selling them to a third party investor). If you don't repay your student loans, then the federal government essentially eats the cost. If you default on your student loans, what about the college or university you attended? What's their financial responsibility? The answer: they don't have any. When you default on your federal student loans, who ultimately bears the cost of those student loans? The answer: the federal government - and ultimately, federal taxpayers like you.

Some people are able to pay off student loans faster. So, while the federal government wants to extend credit so that students can attend college, they also accept the risk that many of these borrowers could default on their student loans. A stronger credit profile typically means a lower probability of student loan default, while a weaker credit profile typically means a higher probability of student loan default. Then, they continue to reap the benefits of their degrees while contributing to society and their career fields.At the same time, some borrowers naturally have stronger credit profiles than other borrowers. “Rose-Hulman’s return on investment allows our alumni to take the necessary steps, through financial diligence and commitment, to pay off their college loan debt.

“We recognize that college is a big investment for students and their families,” said Tom Bear, vice president for enrollment management, whose office oversees financial aid services. A similar ROI Report in 2019 by the Georgetown University Center on Education and the Workforce, using The College Scorecard statistics, found a 20-year net present value (NPV) of $757,000, which ranks 42nd among 4,500 American colleges and universities a 30-year NPV of $1.25 million, ranking 32nd and a 40-year NPV of $1.65 million, ranking 31st nationally.

23 in PayScale’s latest Return On Investment Report with a 20-year return of $798,000. 28 on PayScale’s 2020-21 College Salary Report with an early career pay average of $76,600 that improves to $137,700 for alumni having 10 years of experience in their chosen career fields. Its graduates receiving federal loans had the top average starting salary among Indiana colleges at between $64,000-$108,000, depending upon STEM degree, with 80% of students graduating within six years of their original enrollment according to The College Scorecard. Rose-Hulman has an average job placement rate of 98% within six months when accounting for all graduates for each class, according to the institute’s Office of Career Services.

My family tree will be forever changed,” Murphy shared in announcing her student loan repayment.

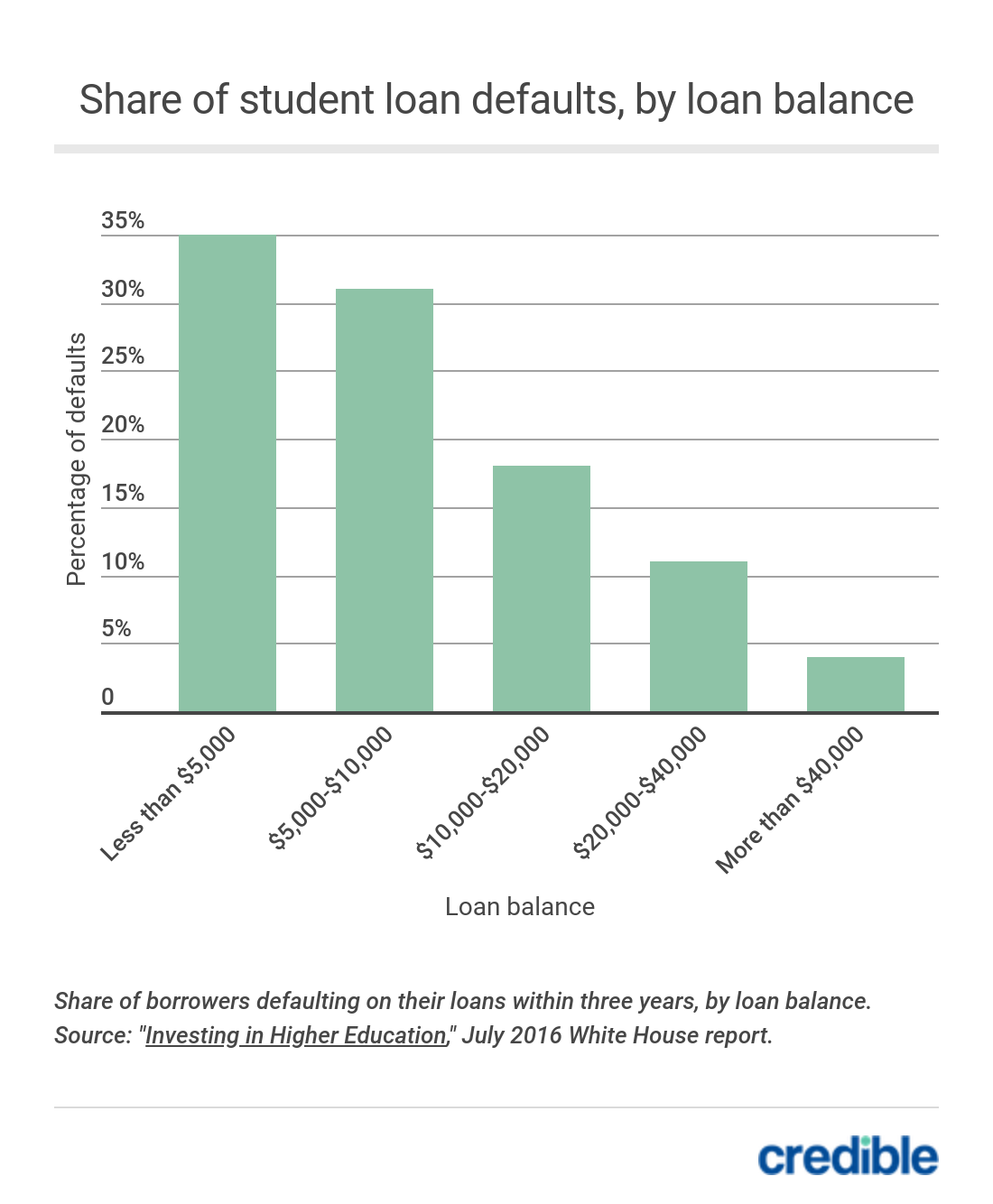

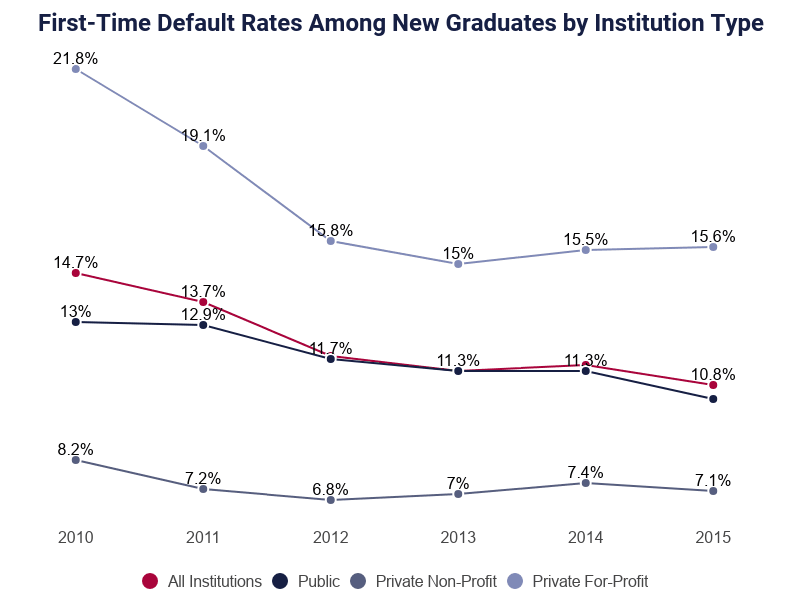

#Alumni student loan defaults rankings series#

The Alumni Relations department’s annual Countdown to Commencement workshop series provides graduating seniors like Murphy with financial advisers and alumni providing information about the importance of managing debt associated with college loans and purchasing homes, cars, and other personal expenses. She is a clinical research specialist with Zimmer Biomet in Warsaw, Indiana. Madison Murphy is a 2017 Rose-Hulman biomedical engineering alumna who paid off her loan debt through financial planning and personal commitment. Historically, the average default rate at Rose-Hulman has been less than 1% since 2013, with the institute also achieving a 0.2% default rate for the Class of 2014. Department of Education student loan default rate information from nearly 4,500 U.S. Rose-Hulman alumni have the lowest federal student loan default rate among Indiana four-year public and private colleges, and among the best in the nation, with a 0.2% default rate compared to a state default rate average of 9.5% for the Class of 2017.

0 kommentar(er)

0 kommentar(er)